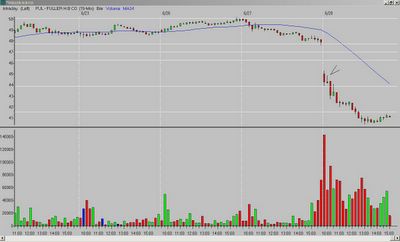

I was worried about the lower tail on the first bar, and the placement of the second bar. Also, I would have liked for the second bar to have been more narrow range. But, as I said earlier, it worked.

X's standard disclaimer applies.*

*as with any entry below/above a previous high/low (in the case of my charts, the opening range (OR) high/low), you need to watch for resistance/support as price approaches those levels. If it stalls, you want to exit. If it breaks through, the odds are good you will have a move to the corresponding Fibonacci extension.

_________

Tags:

Trader-X, Stocks, Fibonacci, Trading, FUL

5 comments:

I decided to try a trade above the fib extension - COH, 15 minute, 12:00. Worked good.

Tom C. Im curious on that FUL trade if you got done near or at the low of the second bar.....I didnt take that trade because i have been getting horible fills on lower volume NYSE stocks. I did hit WEN on the 30 min break of the 3rd bar and NKE break of the 8th bar low.

posted by Tom C:

5150 - I actually only got 70% of the shares I wanted before price moved too far away, so I cancelled the rest.

X talked about NYSE fills a few weeks back, and I agree with you guys. I have thought about only focusing on the four letters, but I can't take NYSE off just yet.

But make no mistake - 80% of the entries/exits are a struggle, and I hate the NYSE.

posted by Tom C:

Nice pick on COH, Bill Bill.

About the the nyse. I like the oils, commodities, and bigger vol stocks. Trying to ween myself of the nyse just because overwhelming.

Post a Comment