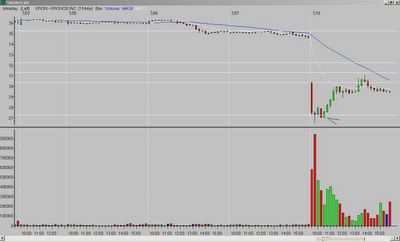

I have discussed set-ups involving "offsetting bars" before - where a down bar that opens at the high and closes at the low is followed by an up bar that opens at the low and closes at the high (and has a similar range).

The KRON set-up is a variation - the fifth bar does not have the same range as the fourth, but it penetrates beyond the fourth bar's mid-point and closes strong. What makes it compelling is that the fourth bar closed below the OR low, but the fifth bar rallied to close back above it.

I sold 1/2 after $1 gain, and the other 1/2 when price hit the retracement zone of the previous day's high to the opening range low.

__________

Tags:

Trader-X, Stocks, Fibonacci, Trading, KRON

3 comments:

ADTN was a good low risk short on the break of 6th 15min bar low. Here are some of the nice features:

1) Gap below recent support

2) OR: wide range and weak

3) 2nd 15min bar: attempted rally

4) Bars 3-6: lower highs

5) 6th bar: NR, IB with weak close in vicinity of OR low

6) 7th bar: decisive take out of OR low

This produced a move to extension zone of previous day's high to OR low before finding support.

Good trading and analysis!

I traded ADTN too. Good trade Jim C.

Post a Comment