1.) What did I see?

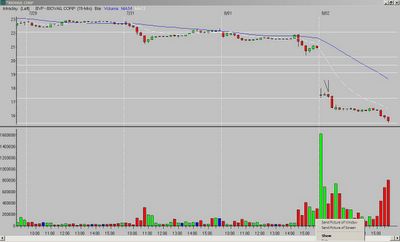

A gap down and wide-range first bar that leaves a long upper tail. The second bar narrows in range, and the third bar resumes the down move, closes weak (in the lower 1/4 of the opening bar's range), and just above the opening range (OR) low (a "hanging-man type" candle).

2.) What is the entry?

A break of the third bar low*.

3.) What is the exit?

The target was the Fibonacci extension of the previous day's high to the opening range low; it was hit at the end of the day. The total for this move was just over 10%.

Set-up grade = B- (the entry was above the OR low)

*as with any entry below/above a previous high/low (in the case of my charts, the opening range (OR) high/low), you need to watch for resistance/support as price approaches those levels. If it stalls, you want to exit. If it breaks through, the odds are good you will have a move to the corresponding Fibonacci extension.

__________

Tags:

Trader-X, Stocks, Fibonacci, Trading, BVF

7 comments:

Nice trade.....X...I missed that one because it was delayed for some time and noticed the setup later in the day. I went long ADBE on break of 3rd bar (30 min) and sold double top.

I'm still learning - don't know if you saw my comment earlier today - I asked how you sort through many possible trades. One answer I got was "the ratings system". Only problem with that is I don't know "the ratings system".

I had two home runs in MDRX and PWR today and I know why I took them (they looked good) but I'm wondering if there is some kind of "rule" you use to get to a "rating". Thanks.

JOhn, check under WELCOME AND LINKS TO KEY POSTS. THere is a post that talks about how he grades set-ups.

Great trade X. One of the advantages to monitoring the gaps through the day. I usually forget to!

TJ

OK - thanks. I looked at them and have a better understanding. I make MDRX an A set up and PWR a B or maybe a B+. At least I wasn't forcing anything. Thanks again.

Why do you wait until after the 3rd bar instead of entering on a break of the 2nd bar low?

Thanks,

chud

I use prophet.net first and foremost and use a 1% gap filter. I got MDRX on the gap up and PWR on the gap down.

If I'm not getting enough out of prophet.net I go to clearstation's bag and tag. That had MDRX on gap ups but didn't have PWR.

I don't use INET much since I see that they are going behind the NASDAQ curtain in September.

To make a short story even shorter I'm a premium subscriber to prophet.net (gets me very flexible real-time intraday capabilities and my broker doesn't know what I'm thinking about) and several months ago I sent them some complaints I had collected. Since that time they seem to have got their business in better order.

Post a Comment