I have given a few examples of what I call the "U" set-up over the past week. CRDN is an example from Friday - after a move down it prints higher lows/higher highs with the 2nd and 3rd bars. The 3rd bar did not close above the OR high*, which made the set-up a little riskier. But, it worked out:

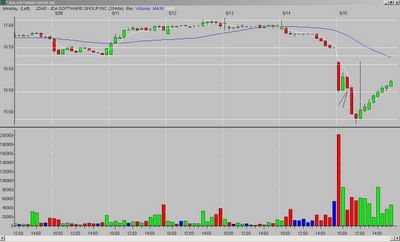

JDAS was an obvious short to me. A gap down and really weak, wide-range 1st bar that closes on its low. The 2nd bar rallies but leaves a small upper tail. The 3rd bar turns back down and closes weak, on its low. It is also a narrow-range, inside bar and has resistance from a declining MA. The entry was a break of the 3rd bar low*.

*as with any entry below/above a previous high/low (in the case of my charts, the opening range (OR) high/low), you need to watch for resistance/support as price approaches those levels. If it stalls, you want to exit. If it breaks through, the odds are good you will have a move to the corresponding Fibonacci extension.

_______________

Tags:

trader-x, stocks, fibonacci, trading, crdn, jdas

No comments:

Post a Comment