KOMG, 30-minute chart - an entry on a break of the third bar low. The third bar closed weak and below the OR low, leaving a long upper tail. It was also the NRM. The target was the Fibonacci extension of the previous day's high to the OR low, but price reversed just short of that area. I covered on a break of the eleventh bar high. Note - some of you may have entered on a break of the fourth bar low, which was a more conservative entry.

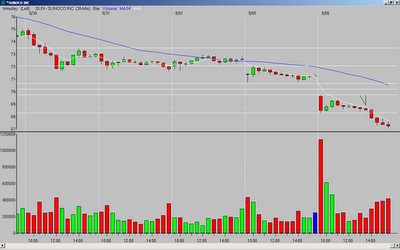

SUN, 30-minute chart - this is a "later in the day" trade that many of you request. SUN gapped down and had a brief rally with the second and third bars before turning back down. The fifth-ninth bars formed a tight narrow range, bumping against but failing to break through the declining MA. I entered on a break of the ninth bar (narrow range, inside bar) low and closed the position at the end of the day for $1+ gain.

__________

tags:

trader-x, stocks, fibonacci, trading, komg, sun

4 comments:

Hey Larry - except VLO worked a lot better than my PD trade!

DCI was a classic. i got shaken out on a swing of VLO a few days ago and it has justed bombed since. got shaken on PMI today - look ouy below!

Can you please comment on your entry for SUN... was there any particular reason for you not to enter earlier, for example break of the low of 5th or 6th bar?

Care to comment on KOMG vs. STX?

I didn't like the second bar (lower tail) on KOMG and ended up taking an entry on STX off the second. I was wrong of course...

Post a Comment