One that worked...

A Tom C. "U" set-up - higher lows and higher highs from the 2nd and 3rd bars. The entry was below the OR high*, so I was watching for a reversal but it broke through and hit the Fibonacci extension in the afternoon.

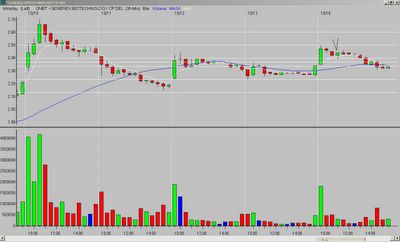

And one that didn't...

The entry was a hammer at support from the retracement zone and the 5MA. It was also below the OR high*, but unlike ECA above it could not break through that level. It reversed on the next few bars, and I was stopped out for a small loss.

*as with any entry below/above a previous high/low (in the case of my charts, the opening range (OR) high/low), you need to watch for resistance/support as price approaches those levels. If it stalls, you want to exit. If it breaks through, the odds are good you will have a move to the corresponding Fibonacci extension.

_______________

Tags:

trader-x, stocks, fibonacci, trading, eca, gnbt

11 comments:

HGT was nice

Price ation like the one for GNBT kills me. When I'm headed to a loss, I would like it to be quick kill. Sorry it's the noooobie in me comming out. But it's so painful to see see something with s much promise SO slowly go down...

For ECA, why did you use the 3rd bar as opposed to the 2nd bar? The 3rd bar doesn't look like it broke through the opening range high.

posted by Tom C:

The 3rd bar didn't break through the OR high, which is why I had the disclaimer*. Actually, I think I mentioned that in the post too...

As far as why 3rd over 2nd - just more info and less risk. It was the "U" set-up I look for, with higher lows and highs...basing it on 2 bars instead of 3 adds more risk.

If you took it off the 2nd bar high, you had a more profitable trade. Congrats!

posted by Tom C:

LP - I know what you mean re: GNBT. It was a nice set-up, except for resistance from that OR high. It just never took off. Some times they work (ECA), some times they don't.

X, would you have taken GNBT?

Tom C - hard to say. It would depend on whether there were "better" set-ups out there. If not, probably...there was nothing wrong with it except what you mentioned.

But, if there had been better set-ups, I would have passed. One thing to consider - take a look at Fibs over just the morning's action. You will see the hammer came right on the middle line of the retracement zone (50%), but closed below the top line of the retracement zone. That meant more risk. Had it closed above the top line of the retracement zone, it would have had a better shot.

X, that's a nice nugget. I never thought of it. I have to start reading the comments more.

X, you are my hero. Thank you.

This blog is awesome. I've noticed that I am getting pickier about the trades I want to enter and over the past 2 weeks, I've lost a grand total of $290, less than 1R. Most of my losses ($900) came in my 1st week, just a few days after discovering this blog. I too was in the 40% winners, 60% losers camp. But it doesn't make sense anymore after reading this blog. Especially for new traders like me, X & Tom's methodology really helps young day traders like me to start focusing on setups and not P&L. I started out with 1 winning and 6 loosing trades, I now am @ 8 winners & 8 losers. Most of my trades are for small shares or small profits. I figure, learn how to trade, take small losses, great setups and manage before I throw real money. The light bulb hasn’t lit up yet for me as a trader, but the longer I survive and build strong trading practices, it will be just a matter of time before the planets will align. I really want to thank you guys for posting your charts as I now able to identify good setups more often. I know I have a loooooong way to go, but at least I now know in which general direction to head off to. Thanks for helping us nubies build a better foundation in such an unstructured environment.

lp, that is the way to do it. And there is nothing wrong with papertrading too.

TJ

I paper traded for a month and was headed to Buffetdom. Way too many good traders told me that it's not the same, not even close. In my thinkorswim platform I can trade almost like the real thing. But what doesn't happen in papertrading is second guessing, fear, slippage, you don't try to find out in great detail why the trade really went wrong, overtrading and you don't care too much about position sizing beacuse it's not real money. I think paper trading is good to somewhat develop a system and understand how to work the execution platform or web page. Once a youngin learns how to do those 2 things, he should trade with real money. Even if it's only 100 shares.

Post a Comment