I did not find a lot of opportunity today. I took a set-up in LRCX that I was not crazy about...but it worked.

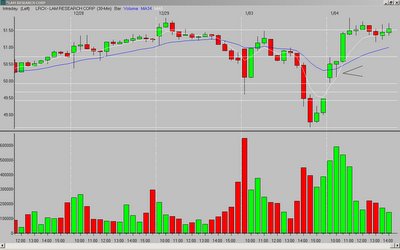

Price gapped up and printed a wide-range first bar that closed strong, but left small upper and lower tails (somewhat indecisive). The second bar formed a hammer-type candle on support from a rising 5MA. Both bars also closed above the 34MA.

I entered on a break of the second bar high, and price quickly rallied to the Fibonacci extension of the previous day's low to the opening range (OR) high.

I am out for the rest of the day. Enjoy your afternoon.

_______________

Tags:

trader-x, stocks, fibonacci, trading, lrcx

14 comments:

Happy New Year X,

I saw LRCX also, but on my esignal chart the hammer was below the 34MA, which caused me concern. I wonder why mine is showing up that way. I am using a SMA for the 34 period.

Thank you

30 minutes VS. 15 minutes?

Actually, Trader-X and I talked about the MA's in 2006, and standardizing on either SMA or EMA instead of one of each. My argument was EMA, X didn't really care. So these are EMA, as we both use the same chart template.

I looked at LRCX with the SMA instead, and you are correct. That would have kept me out of this trade.

In the long run, I don't think it really matters if you use SMA or EMA. Either way, you will find set-ups in one and not the other...but it all evens out. Today, the EMA proved better with LRCX.

I hope everyone had a Happy New Year, and I should be back to posting a few charts next week.

Tom C.

Hey Tom C., welcome back and Happy New Year.

I was wondering the reason you preferred EMA over SMA. Thanks!

Glenn - because we focus primarily on gaps, and the EMA seems to provide a smoother line than the SMA.

Tom C.

Welcome back Tom C!

Trader-X, great blog. Just curious why you said you were not crazy about this setup.

Thanks.

To bad you were out for the rest of the day. Short oil and long tech.

GOOG, on the 15 min. break of the 13th bar hammer above the opening range bar...rode it all day way past the Fib. ext. Wish I could of purchased more than 100 shares!

AMD... LONG on a short Lemon Squeezzze!...also bought some calls out in the future.

INTC...long

MRX.. 15 min. chart purchased on the break of (main body) of the fourth indecision bar for several reasons, Higher lows and higher highs from the Opening range gap up. The 4th bar closed above the OR bar and the previous 3rd bar so the fifth bar at $36.45 was the offer with a stop at 36.37. 8 cents risk. sold at the fib extention six bars later on the 11th bar at 36.81 or an R7 gain. MRX fromed a couple of hammers at the 15 and 16th bars but I stayed out of it...MRX later closed higher at 37.14.

Took a huge profit on shorting USO Wednesday, covered this morning on the lower gap as expected. New short position on the 36th bar of the 3 min. chart at $48.69. covered 80% of the short position at $47.35 near the end of the day on the showing strength.

Tech. looks real strong here guys, I think we may see a strong rotaion out of OIL/GAS and into the SEMI and TECH. area.

PS. I almost puked when Nancy P. gave her speech about Dems and Republicans working together...like that's gonna happen LOL.

Lets here your trades!

If I had to guess, I would say he wanted a more narrow-range trigger bar. Just my .02.

TJ

Nice trading and analysis Kayak. I enjoy reading your comments!

Traded MO long off the 4th bar on the 15-minute chart.

ERTS was nice but I missed it.

Happy New Year X,

Been a reader of the site for a while. Tons of useful info and love reading about your trades. I decided to start my own blog and was wondering if you could link me? The address is:

www.bvitha.wordpress.com

Thanks again

Thanks Marc,for the kind words...I don't always get things right.

It's Friday, Jan. 5th at 9:20 eastern just before the market opens.

Look for some early morning weakness in the over all markets except maybe transports? As for me" 'I will be waiting for the market to turn around mid day - to late in the day, I will be looking for the bargains in Tech. again, and in Healthcare and Pharma...also the financials that the lower friday market offers.

Tom C. is right re: Ma's.

TJ is right on the set-up.

Post a Comment