Regular readers know that I use MAs in my trading. One setup I like to trade is a large gap where price moves in the opposite direction (of the gap) to tag the 8EMA - you can think of it as a "reversion to the mean" trade.

Please note, this is a higher-risk setup; it is higher risk because price does not have to rally (or fall) to the 8EMA...it can move sideways until the 8EMA "catches up", or it can continue in the direction of the gap at a slower pace until the 8EMA "catches up". So it is important to only take strong setups with good candlestick patterns.

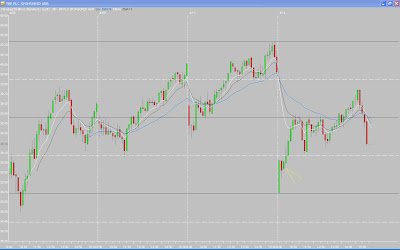

BP from today is a classic example of the setup I like. Price had a large gap down but the first bar was strong. The second and third bars consolidated in the upper half of the first bar's range with the third bar being solid green (opened near the low, closed near the top). It was also a narrow-range, inside bar.

I bought on a break of the third bar's high, and my initial target is the 8EMA (white MA line). I also look for other areas in the vicinity to confirm (or adjust) my target. As you can see on the second chart, I plot my Fibonacci lines over the previous day's high to the OR low and the 50% retracement is just above the 8EMA. I closed the position at that level, and it proved to be solid resistance throughout the morning.

_______________

10 comments:

I was also watching BP at the time. Didn't take the entry as the bar was wider than I would like (2nd 15-min bar). I took a somewhat B-to-C grade setup later in the day (long at break of 20th bar). The idea was breakout of ascending triangle above the 50% retracement level, hopefully filling the gap if there is a long rally into the close. Exited at break of 23rd bar at around breakeven. Could you comment on the trade? Thanks a lot!

Nice Tom C!

Hey. When i see a gap like that i am inclined to look for a short.

Why? The moving averages are stacked and running down, the opening price has taken out 2 significant lows, the pullback tests the 13 ema, and the candlesticks are spinning tops inside bars.

Am i looking at things the wrong way?

Are all of your gap trades longs?

Anyone is welcome to reply. Thanks.

d

TL, I will look at it and post a follow-up comment.

Anon, no - I take as many shorts as longs. But I take the setups that materialize without having a bias. On BP, a long setup was obvious but I was also aware of the resistance you pointed out, which is why I sold at those specific levels. Also, as I said in the post, this was a reversion to the mean type trade.

This is a great post Tom C. You really opened my eyes to how to use MAs, something I never really considered before.

TL, there is always hidden resistance. It looks like price ran into both the R1 Pivot Line and the 1/2-way point between the high and the FE of the morning's range. I'm not normally looking for setups based on that criteria, so it is hard for me to comment on the quality of it. Just pointing out what I saw.

Tom: please, let me understand you with respect to you don't having a "market bias": do you really mean that you don't favour short positions on a day like yesterday and long positions in an up day?...I'm a beginner and I feel more comfortable looking for shorts in a day like yesterday. From your point of view and your experience, do you really think that the movement of the whole market doesn't affect the setups your are trading?...You are not following the ES or the NQ when looking for setups?...This is a question that it's very difficult for me to understand...Thank you very much for your help and please excuse my english and my lack of knowledge...

Luis, first understand that just because I do something does not mean I am trying to get you to do it my way. Everyone has to find what works for them (as X always says).

Having said that, no I don't look at the overall market. I have a good idea what is going on based on the number of gap ups vs down, and how they are moving. But I pay no attention to the market direction when it comes to taking a setup. Why? Because it can change at any second. And I don't try to analyze the market because it just adds more complexity to my trading.

Usually the setups that come along mimic the market movement. But when they don't - and they are indeed good setups - they tend to work out regardless of what the market is doing. I have had great longs in a tanking market and great shorts in a rallying market.

This is the same philosophy X has - in fact, I copied it straight from him.

Nice setup and trade. Thanks Tom C.

Thanks for the reply!

Post a Comment