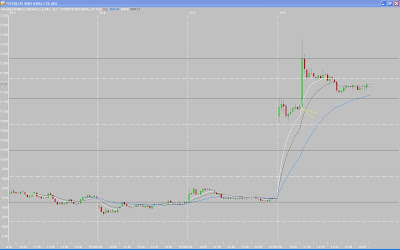

SLT was a great setup. Here is what I saw/did:

1.) A gap up, orderly pullback, and move back into the upper half of the morning's range with bars 7-10.

2.) Bar 10 touched the 8MA and closed bullish.

3.) My Fibonacci lines were plotted in classic X-style - from the previous day's low to the OR high.

4.) I entered on a break of the 10th bar high, and sold at the FE a few minutes later.

SLT had good volume (almost 6 million shares for the day) and it was easy to get into and out of; they don't all happen this fast or offer this big of a return, so it was a great way to start the week.

_______________

5 comments:

Hi Tom,

Great trade. Do you sell once it reaches the FE or do you see how price reacts at the FE?

thanks

Hector

Great trade - I am really digging how you use EMAs.

Where is X hiding these days? Not many posts lately.

Hi Tom,

Great post as always. I have a question for you. Have you always used 10 minute charts in this manner or did you make the switch at the start of the year with X.

I've been trying to stick with the 15 minute charts, but the set ups I see you guys doing well with are on the 10 minute charts. I would really like to know your thoughts on the differences between the two.

Thanks

Hector - on a massive move like SLT, I usually take all profits at the target. In other cases I may wait to see if price is going to break though that level, but I would still sell 1/2.

Larry, X is doing some consulting work for some traders and I think part of the agreement is that he does not post charts during that time. I will let him add more detail.

I trade 5, 10, and 15 actually. The biggest difference is the speed of the trade, and the number of setups/opportunities.

5 will hit the target sooner, and will give more setups (which means if you are not taking the right setups, you will lose more money). 10 is a happy medium as X pointed out earlier in the year.

Post a Comment