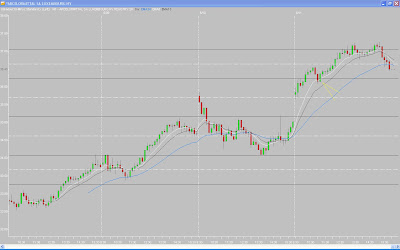

Here is another example of the type of setup I wrote about last week. It was not perfect, as I prefer price does not break the ORH when it pulls back to re-test. But it formed a compelling bullish pattern with "offsetting bars" at support from a rising 8EMA.

I entered on a break of the 11th bar high and closed the position at the FE.

I know there are comments I have missed over the past week - if I have not addressed a question you asked, feel free to do so again in "Comments" of this post. But please read "WELCOME AND LINKS TO KEY POSTS" before doing so (this link is at the top of every page).

_______________

7 comments:

Hi Tom, thank you for posting your trade. I notice recently that you use 10min or 30min as open range. I am wondering how you decide which one to use in your trades. thank you.

Song

Hi Tom,

Thanks for taking the time to post your trades. I hope its not too much to ask, but is it possible to show examples of swing trades, the ones you take. thanks Hector

Hi Tom,

Much thanks and appreciation for you and X. I have a problem I've been hesitant to ask about, but I can't take it anymore.

I do a pretty good job of picking the right stocks, waiting for the the set ups to trigger and entering into position. But for the life of me, I have not been able to just let the trades work out. Over and over I get so anxious, take profits 1/5 of the way to the target and then watch in agony as the targets are reached.

A great example would be X, United States Steel today. I entered on the break of the 11:00 (10 minute chart) candle. My target was the 1.50 Fibonacci extension. But I completely exited the trade before it even reached 42.00. I do this ninety-five percent of the time.

The win/loss ratio of the set ups I take is pretty good, but I am never in them for the full trade.

Can you or X offer any advise for overcoming this? Am I the only one struggling with this?

I have learned so much from you guys, and I am eternally grateful to you both. Thank you.

Nice trade, I took a riskier entry on the 4th bar and added on your entry which was a better one.

Do you have a minimum volume criteria when you build your watch list ? How many stocks do you end up with on average in your list ? I remember X used to have anywhere between 20 and 40.

Hector - yes, I will do that. A lot of people request swing trades and since the 1/2-year point is coming up, I will be reviewing my trades and post a few.

loanme - I don't have any advice except to say find setups you are confident in. We get spolied by the ones that work immediately - they go straight up (or down) after we enter. But in reality there is usually ebb and flow, and a stock will quite often run and retrace all the way back to your entry before really exploding. So you have to have confidence in your setups to know this will happen. The only other option is taking 1/2 off the table when you have the urge to sell, and letting the other 1/2 go to the target.

Song, check comments here:

http://traderx.blogspot.com/2009/06/nvax-060409.html

grey - no, no minimum volume when it comes to putting stocks on the list. But I sort by volume that constantly updates, so I only focus on the top volume stocks. The list may be 40-50, but I am looking at the top 20 by volume (which changes throughout the day).

Tom, thank you very much for sharing. I found the answer in the comments. Have a good weekend.

Song

Post a Comment