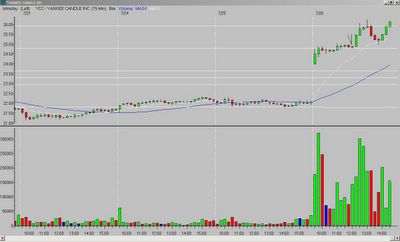

Fortunately, there were some opportunities later in the morning. YCC was probably the best:

1.) What did I see?

A gap up and wide-range first bar. The second through sixth bars narrow in range and consolidate under the opening range (OR) high. The seventh bar moves above the OR high, and the eighth through eleventh bars consolidate above that level (resistance now becomes support). The eleventh bar is narrow-range and forms a hammer on the OR high.

2.) What is the entry?

A break of the eleventh bar high.

3.) What is the exit?

The target was the Fibonacci extension of the previous day's low to the opening range high; it was hit two bars later.

Set-up grade = B+

Note - an alternate entry was a break of the sixth bar high. It was somewhat riskier as it occurred below the OR high.

__________

Tags:

Trader-X, Stocks, Fibonacci, Trading, YCC

1 comment:

I was in YCC too. Nice trade. And nice interview earlier.

Post a Comment