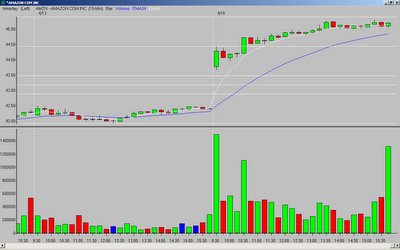

X would have had two problems with this trade:

1.) Entry below the OR high.

2.) Entry was a little removed from the 5MA (meaning price could have pulled back).

But as he says - if you are aware of the increased risk, you can still make good trades. I entered on a break of the 4th bar (hammer) high, and sold at the end of the day (price just missed hitting the Fibonacci extension of the previous day's low to the OR high).

I would give this set-up a "C+" (maybe a "B-").

X mentioned the VA. Tech shooting earlier - it really has me shaken up as my daughter is about to go away to college. I feel terrible for all of the people affected by the tragedy.

_______________

Tags:

trader-x, stocks, fibonacci, trading, amzn

4 comments:

i was in and out of this one pretty quick, i didn't like the setup after i got in so i took a few cents in it. i've noticed lately that only a hanful of these setups, even ones that look good, ever reach the fibonacci extension target. they still make good runs though, as long as you watch the pullbacks.

Tom C,

Yes bless all those involved in that shooting. Here's what I saw today on 30" charts with b/o hammers only, OR high or not : solf5 amzn2 lend3 fmcn7 jaso3 apol2. 15" same: solf9 fmd3 apol6 amzn3 netl5 eric5. Traded JSDA6/30" out way soon, AQNT4/5" fib retracement previous bar, FMCN7/30". So true what TraderX says about being able to trade the set up in any time frame. I'm seeing 1,5,10,15 set ups all over fmd8/5" hammer reversal solf 3/5" b/o, jsda 8/1" b/o!, jaso 3/5" b/o. Must say it can be risky but each stock trades in its own time frame(s) and the shorter the time frame the less watchlist should keep. I had 16 premkt naz stocks and finding that it can help indentify volitle candidates.

"and the shorter the time frame the less watchlist should keep."

Good advice.

How far is too far away from the 5MA?

Post a Comment