"Trader-X, I would like to get your thoughts on KO. 4th bar hammer, 10-minute chart. Would you have taken it and why/why not?

Thanks for a GREAT blog."

My response was:

"Joe-

If you draw a line at the halfway point between the high and the 50% retracement of the first 30-minute's range, you will see the hammer formed just below that level.

The next bar tried to break through that resistance, but failed and left an upper tail. Price then fell back to the 50% retracement and rallied off that level, breaking earlier resistance and moving to new highs.

There is nothing wrong with taking the hammer entry if you accept the higher risk of having resistance just overhead. Sometimes it will break through, sometimes it will not. A more conservative approach would be to wait for a better entry later...knowing that you run the risk of missing a few setups that will take-off right away."

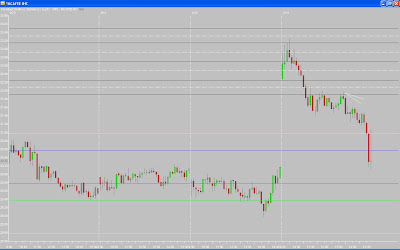

Here is the chart of KO:

That leads me to reiterate a point I made in a post earlier this month about blog workings:

1.) If you have a question about a trade, DON'T EMAIL IT. Post it in comments. I do read every comment, so if you post it I will read it and most likely respond. But posting in comments gives you the added benefit of having others offer input - I always see RJ, QQQBall, Z, Jim, and others offer advice, thoughts, and suggestions. And frankly, many of these people are smarter than me!!!

Additionally, if you are not reading "Comments" on the posts you are missing out - there is often some good information there.

There were several good setups on Friday...I will try to post a few more charts over the weekend (no promises), but here is one that stands out.

MFE gapped up and the first three bars left long upper-tails. The fourth bar made a new high and reversed to close below the halfway point between the morning's high and 50% retracement.

I entered short on a break of the fourth bar's low, watching the 50% retracement as an area of resistance that would have provided a bounce (and ruined my trade). The fifth bar broke below the 50% level, and although the sixth bar closed back above it, it left a long upper-tail. Price declined from that point and I covered four bars later at the FE.

I actually made a rare late-day trade in MFE, re-entering as price formed a bearish candle on a retrace to the FE (see the lower white arrow). This is a setup that can be found throughout the blog...search "Beyond the Fibonacci Extension". It was a riskier trade as it occurred later in the afternoon, but I had a great morning and MFE was showing continued weakness. I covered at the R1 Pivot line (blue line).

_______________

15 comments:

Hey trader-x

For the mfe trade where was your stop after the 5th candle formed and the 6th bar started trading above the high of the 5th candle? I understand that the 6th candle formed a long upper wick giving you confidence to hold, but I know for myself as an inexperienced trader, in real time, once that 6th candle starts to trade above the high of the 5th candle I start to get nervous and think the trade might not work out and get out too early thus causing me to miss that entire down move. Do you just keep your stop above the high of the candle that you entered off of throughout the entire trade?

Guys, if you are going to post a comment post a name with it...make one up, it doesn't matter. It is just a pet peeve of mine.

As far as the question, my stop is always the opposite extreme of the entry candle. While I do watch price action and sometimes exit early if it looks to be reversing, you have to balance that with giving the stock room to "wiggle". 75% of the time they chop around. As I explained in the analysis, I was not worried about the sixth bar because it left an upper-tail.

Be careful making decisions "intrabar" - while a bar is forming. How it ends is often drastically different than what it does in the middle.

Also note, I might have thought differently if the fifth bar failed to close below the 50% retracement...that would indicate it was bouncing off that level.

Hi,

Your blog is a great place for learning.

I was going through your posts and noticed another chart which is very similar to MFE.

http://4.bp.blogspot.com/_rgAZ6IYoR7E/STwAtM2dBwI/AAAAAAAAAYM/o5Ddh8r73-U/s1600-h/HIG120508.bmp

http://traderx.blogspot.com/2008/12/weekend-roundup.html

But the HIG was a great long entry trade whereas MFE was such a great short entry. In case of HIG , the sixth bar closed below the halfway point between ORH and 50% retracement. But next bar turned out to be a good long entry .

What else am i missing ?

Thanks in advance.

Learner

Learner-

Thanks for the kind words.

On HIG, I looked back on the post and there are a couple of things to note - first, I didn't trade it...I stated I missed it but I put up the chart because it was a nice move. Second, it is a five minute chart so you are comparing two different timeframes.

Even still, I don't see a short entry on HIG and I don't see many similarities to MFE. Since I don't enter trades in the first 30-minutes, I would not have been in HIG prior to the seventh bar. And the only thing I see from that point forward is long setups. In very general terms HIG is a classic long...gap up, rally, pullback, rally to a new high and a breakout above the FE.

Hi X,

Great trade on MFE. Would you have considered a short of WYN (feb 13th) on 10 mins. Looking back i could see an entry on the 9th bar which was a NRB.

Thanks and i hope you feeling much better.

DEM.

Hi X,

On the later MFE trade, would you have considered shorting after the 18th bar put up a long upper tail as well? The 18th bar looks similar to the bar you actually shorted on except for the body color. Hope you're enjoying your long weekend. Thanks!

Hi Trader-X

Can you offer some insights as to managing risk on positions, if you have more than 2 trades open. I'm getting a hang of X setups but can't seem to look away and therefore getting hung up on watching the postions and missing other great X setups. Thanks for your thoughts.

Hi X,

just want to say congrats on your blog it is excellent and has helped my own trading immensely.

I have a question regarding a couple of charts you posted last week which were quite similar the DLR and APOL charts where you traded long after a pullback to support. I noticed that DLR actually closed above the 30 min ORH before pulling back (altough the candle that closed above the OR had a long upper tail)whereas APOL never got above the ORH. Does that fact that the price had closed above the OR before pulling back make the trade more risky or does this not generally make any difference to the setup.

thanks for all of your insight and carry on the good work

Mark

DEM-

I find that pullbacks like WYNN are lower probability FOR ME.

I stress "for me", because it seems like WYNN is a good setup just looking at it - I don't see any issues and the pattern you describe is spot-on...I just don't like these setups in general FOR ME!

Thanks for reading.

Golden Bear-

I skipped it because the bar closed positive (green). All things equal, it is lower probability. I have taken such setups in the past, but it is also a function of how many trades I am in, if there was a better setup elsewhere, etc.

BL-

This gets to the heart of how many trades you take, how many you have open, how many you can monitor, et cetera.

For me, my philosophy has always been take fewer trades but make them high-quality. I am selective, mentally I classify trades into "A", "B", "C"...and I try to take only the best.

I can only monitor a 2-4 open positions at one time, so I want them to be the best. And once I am in, I keep a close eye on price action and what is happening in the trade.

I don't know if I answered your question, but to summarize:

fewer trades

better setups

monitor the ones I am in...

The bottom-line is I miss a lot more trades that I actually take, but that does not bother me. In fact, it makes me feel good. I like looking back through the day and seeing all of the opportunity, and as long as I made good money on what I did trade, I don't kick myself (often).

Hi Trader X,

A similar "top out" setup occurred in VAL on Friday on the 10-min bars. However, this one seemed to be a loser. I notice that the shooting star that forms as the 4th candle does not close below the halfway point between 50% retracement and the top of the OR, as occurred in the MFE setup. Is this a sticking point for you for taking a trade such as this?

Thanks for you all your hard work!

armo70-

What is most important for a good setup is that the run and pullback happen in the first 6-9 bars, the earlier the better (getting towards 8, 9 is riskier).

Having said that, if all things are equal I will take a setup that has not tagged the FE yet, but nailing the high or just breaking it are fine. DLR came close to tagging the high, but just missed it and left a long upper tail.

Sunyata-

I like it to either close below the halfway point or be a weak bar right on the opening range high.

At first glance, VAL was the latter. But if you look at the fourth bar in relation to the first three you will see that price was very strong on the third bar as it left a lower tail and closed with a wide-range, green body near the OR high; I would have been worried about follow-through on any down move on the next bar.

Having said that, the first target/area of resistance on entering this type of setup at the high is the halfway point between the OR high and the 50% retracement. VAL hit that mark, and then bounced. There was not much profit potential in that move, so I would not have taken the setup for that reason along with the one I listed above. But the long tail on the fifth bar at that level should have allowed you to get out breakeven at least.

Thanks!

Post a Comment