Following my prescient post on the general markets Monday, the markets sold off.

: )

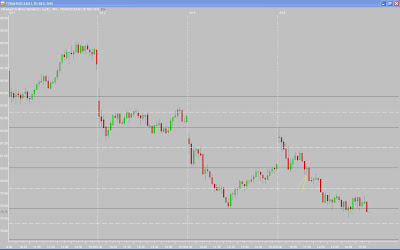

You could throw a rock and find good shorts yesterday and today. One of my better trades was RIG. It gapped up and fell to the 50% retracement from the previous day's low to the OR high. It bounced and then rolled over and fell back below that level. Price formed a "hanging man" type candle, and I shorted on a break of that bar's low. I covered the short at the previous day's low.

_______________

12 comments:

nice work with the reversal

X, Tom...am an older fan of you site who'd like to see how do u manage a wrong pick (i mean in case somethin go wrong after u have entered)

THX D

D, how I handle a trade that does not go in my favor is simple - I close it if my stop is hit. My stop is almost always (99%) the opposite extreme of the trigger bar.

I have not had any losers on Monday and Tuesday. If I have one today or tomorrow, I will post it.

Tom,

I appreciate the charts that you provide for newbies like myself to learn from experienced traders.

I wanted to ask you how many trades do you make on an average day. Also, do you manage multiple positions or just take them one at a time. Thanks again for the inputs.

Anyone See PL Today (Thurs 6/18/2009)

Caught me off guard because i thought it had set up for a perfect Push Through setup. It baffles me that this one didn't work out. the only thing i can see is that maybe the volume was a little light.

I entered on the break of the third bar and was stopped out at the low of the 3rd bar on bar 5. 10min timeframe. Any insight would be helpful

Thanks

Zo

"My stop is almost always (99%) the opposite extreme of the trigger bar."

it would be great if in the chart u post u could also note which one it will be your stop like u do for the entry point (even if it's not a loser)

Just look at the yellow arrow on Tom C's chart. The stop is the opposite of the entry on that bar. Simple.

I am a little confused also. I have interpreted it as, for example, If entered on bar 4 lets say going long, the stop placement would be the bottom of bar 3 since the 4th bar would not have finished forming yet, or would it be the bottom of bar 4 and if the bar is still forming and reverses to your stop then exit, or let it ride until the bar finishes forming and then exit if it breaks the low? Newb trader here. Can you help me out here Tom, X

This is not hard. Your stop is the opposite of your entry on the trigger bar. If you go long when price breaks the high of the trigger bar, your stop is the low of the trigger bar. If you go short when price breaks the low of the trigger bar, your stop is the high of the trigger bar.

Tom C, I would love to see more posts. Keep up the great work!

Zo, I will look at it this weekend.

Todd-O, thanks for clarifying. I see no reason to list my stop unless it is NOT as you describe. It is as you describe 99% of the time.

Have a good weekend all.

Zo, hard to say with PL. I know it would not have appeared in my list due to volume, but that aside it may just be a trade that didn't work.

Any other opinions welcome.

Thanks Tom

I started thinking that too. Just one of those that didnt work out

Thanks a bunch

Post a Comment