The market began to reverse today on the third 10-minute bar and by the end had already moved off the morning high. So a classic "top out" setup was not in the cards.

But a variation of the "top out" setup did occur in many stocks today. It is a setup that carries more risk, but one that has worked well in 2009. It happens when the third bar closes below the half-way point between the high and the 50% retracement of the morning's range (represented by a white dashed line on my charts). I enter on a break of that bar's low, with an initial target being the morning low and my "stretch" target being the FE.

As always, my stop is the opposite extreme of the entry bar unless otherwise indicated.

MET is an example that I traded today. My entry was a break of the third bar's low, and I watched the 50% retracement for early resistance. The fifth bar sliced through that level and moved down to the morning's low; the sixth and seventh bars moved down to the FE and bounced exactly at that level (I covered at the FE).

You can find many more examples of this setup today, including the NQ futures.

Another variation occurred in ORLY, where the first bar left a long upper-tail and the second and third bars could not close above the half-way point between the high and the 50% retracement. The S2 Pivot Line (yellow line) also served as strong resistance. I covered the position at the morning low (it was a round number ($29) and I had other positions to monitor...otherwise I may have stayed in longer).

In retrospect, I didn't like the first bar on ORLY as it also printed a long lower-tail...it worked out well, but I don't like taking setups that follow a candle with both long upper and lower-tails as they carry more risk.

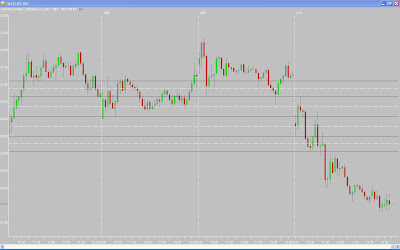

DLR was a setup I traded on the long side. It can be classified as a "perfect pullback" setup. Price gapped down and moved up sharply with the first four bars. The fifth and sixth bars pulled back, and the sixth bar formed a textbook hammer at support from the half-way point between the high and the 50% retracement (the tail actually tagged the 50% retracement and bounced off that level).

My entry was a break of the sixth bar high, and my exit was the S1 Pivot Line (green line) which was just above the FE. Normally I would exit at the FE, and if price had reversed I would have closed the position. But with the Pivot Line being just above the FE, I knew there was a high probability that price would rally to that level.

_______________

18 comments:

Hi X,

Thanks again for another great post. Could you have a look at CRL on the 10 mins. Looked like a great setup on the 3rd bar.

Thanks

DEM

DEM - wow, that did not even make it on my list. Nice move that rallied to the FE and then reversed at exactly that level.

Great trade.

X,

I wish i did ... I did not make a "real" trade because i am paper trading in real time. Still learning. But i think it reflects your main principles and it's the only "trade" i took today.

Thanks.

Bravo DEM, focus on just one or two setups like X says and you will find success when you start using real money.

X, good trades. I took a short similar to MET. DLR happened too fast for me.

Take care.

RJ

I like shorting DLR on the break of the 5th bar low. The Previous days low acted perfectly as resistance.

Anything against that entry?

hypr-

I think you mean the 9th bar, not the 5th? Unless I am looking at something different.

The 4th bar of DLR was shooting starish at the previous days low which acted as resistance $34.45. The 5th bar was a narrow range almost inside bar. Narrowest of the morning. Short the break of the 5th bar.

The entry was pretty much only based off of the previous days low as resistance.

I would have been stopped out of that trade, because price took out the previous high. Where was your stop on that trade hypr?

I was just pointing out a setup that did not work. Looking for reasons why it failed/was a sub par setup.

I commented on the entry since it popped out to me when i saw the chart. The stop would have to be at the opposite end of the entry bar or at the top of the shootingish star.

IMO, hypr, that was a very weak short setup. First, the fourth bar - while it did leave an upper tail - had a pretty wide range green body. Not as weak as it seems. Second, it closed ABOVE the opening range high if your are looking at the first 30-minutes. Pretty bullish. Third, there was support from the white dashed line which X points out, and where the hammer formed.

If it had been a true shooting star with a weak, RED body I think it would have been a more valid setup.

My .02.

RJ

Hi X,

Great trades and good comments for learners like me.

Keep it coming.

Raj

Thanks RJ!

So you would never short above the OR?

Does the setup look any better on a 5min chart? Entry at the break of the 9th bar.

hypr, compare that to AG which rallied to the previous day's close and had a similar candle, but did not close above the or high.

You can compare my entry to an oldschool one that Tom C. did.

http://traderx.blogspot.com/2006/08/some-charts.html

The AZN chart.

If you look at the bar before the entry on DLR it has a upper tail signaling weakness when Toms had no tail.

His entry was way farther from the OR and it was a 30min chart.

@hypr - you are comparing a short on a 10-minute chart to a long on a 30-minute chart. I don't know that is a good thing.

I agree with the earlier comment that the shooting star on the short setup was not really a shooting star, as it was a positive close with a wide real body. On the 30-minute chart you reference, the long entry was a narrow range hammer like candle, much better signal in my opinion.

But again, I have an issue with the comparison in the first place.

: )

Trader-X,

What a great blog and thank you for sharing so much. I just found it, and wish I had years ago. Good trades today, I look forward to reading in the future.

slick exit on DLR... nice plan

Thanks QQQ. Some more comments on DLR - when I enter a long trade on a gap down like this, I like for it to have room to run before entering the previous day's range. Thus, the more white space in the gap, the better.

DLR was a little tight, but I liked the setup and saw the green pivot line as a magnet pulling price to it. I knew when I entered it would be a quick exit, though.

Have a good day trading.

Post a Comment