I talk to numerous people through email every week who are struggling to be successful at trading. And, I find two common traits in most of them:

1.) They trade too much - most of the people struggling make multiple trades daily, some as many as 10+ round trips.

2.) They have a lack of focus.

I will start with #2. I have discussed this in the past - most people jump from indicator to indicator, timeframe to timeframe, method to method. They will use something for a few days, hit a bump, and move on to something different all together. One day the holy grail is a XX period moving average, the next day it is MACD or an oscillator. One day it is a 30-minute chart, the next day it is a 5-minute chart. One day it is buying the break of the first inside bar, the next day it is a pullback from the high.

I call this "chasing success". The bottom line is the person does not spend enough time on any one method to really understand and execute it properly. They bounce around, and before they know it a lot of time has passed and they are still struggling.

If you pick something and stick to it, you get good at it. Once you get good at it - once you perfect it, THEN you can add something else to your arsenal.

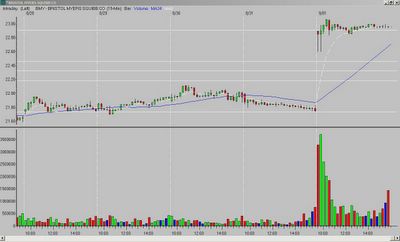

There are plenty of set-ups I have highlighted in the blog that have a 70%+ success rate. Do you want an idea? Look at 30-minute charts that break the opening range high, then pullback and consolidate with a textbook hammer at a key moving average. You may ask, "well how many of those are there a week?" My answer is a pretty high number - you just have to focus and find them. But, say you can only find 2-3 per week. Would you rather have 2-3 great trades and a positive, money making week? Or 30+ trades and a negative, losing week?

Regardless of what set-up you choose, focus on it and study 1,000's of charts. Analyze the details - does it work better when the tail of the hammer also touches the opening range (OR) high or the Fibonacci extension? What produces better results - a slow, 3-5 bar pullback or a violent 1-2 bar correction? Does it matter if the bar preceding your hammer is narrow-range or wide-range? What about the hammer being green (closing positive) vs. being red (closing negative)? Learn your set-up inside and out!

A final thought on #1 - why do you want to make 20-30 (or more!) trades a week when you are losing money? Stop trading so much! And a way to "force" yourself to do that is to FOCUS on one thing. Pick a timeframe. Pick a moving average. Pick a set-up. And wait for it to happen. What do you do while you wait? Study charts!!! And if a day passes and you do not make a trade, so be it. Look at it as a positive - you did not lose any money!

And feel free to email me when you think you study as many charts a day as I do!!!

_______________

Tags:

trader-x,

stocks,

fibonacci,

trading